A Holistic Wealth, Tax, Estate, Trust & Asset Protection Plan

PRIVATE LEGACY PLANNING & ASSET PROTECTION FOR YOUR WEALTH, FAMILIES & BUSINESSES

Everything starts with understanding how your assets are structured. We will craft a customized plan that promises continuity, minimizes tax liabilities, and preserves your wealth for generations to come.

Trusted by Families and Corporations Who Expect Excellence

In Assets Under Management

Building lasting stability and financial security to protect your legacy today and for decades to come.

in Claims Paid

In 2023, Filipino families received actual life and health insurance guaranteed benefits.

Individuals Protected Lives

Families protected by individual policies show the real value of trust and coverage.

Group Members Covered

Through employer-backed programs, offering wide protection across industries and business sectors.

in Combined Premium Income

Signaling consistent market performance and resilience even during times of global uncertainty.

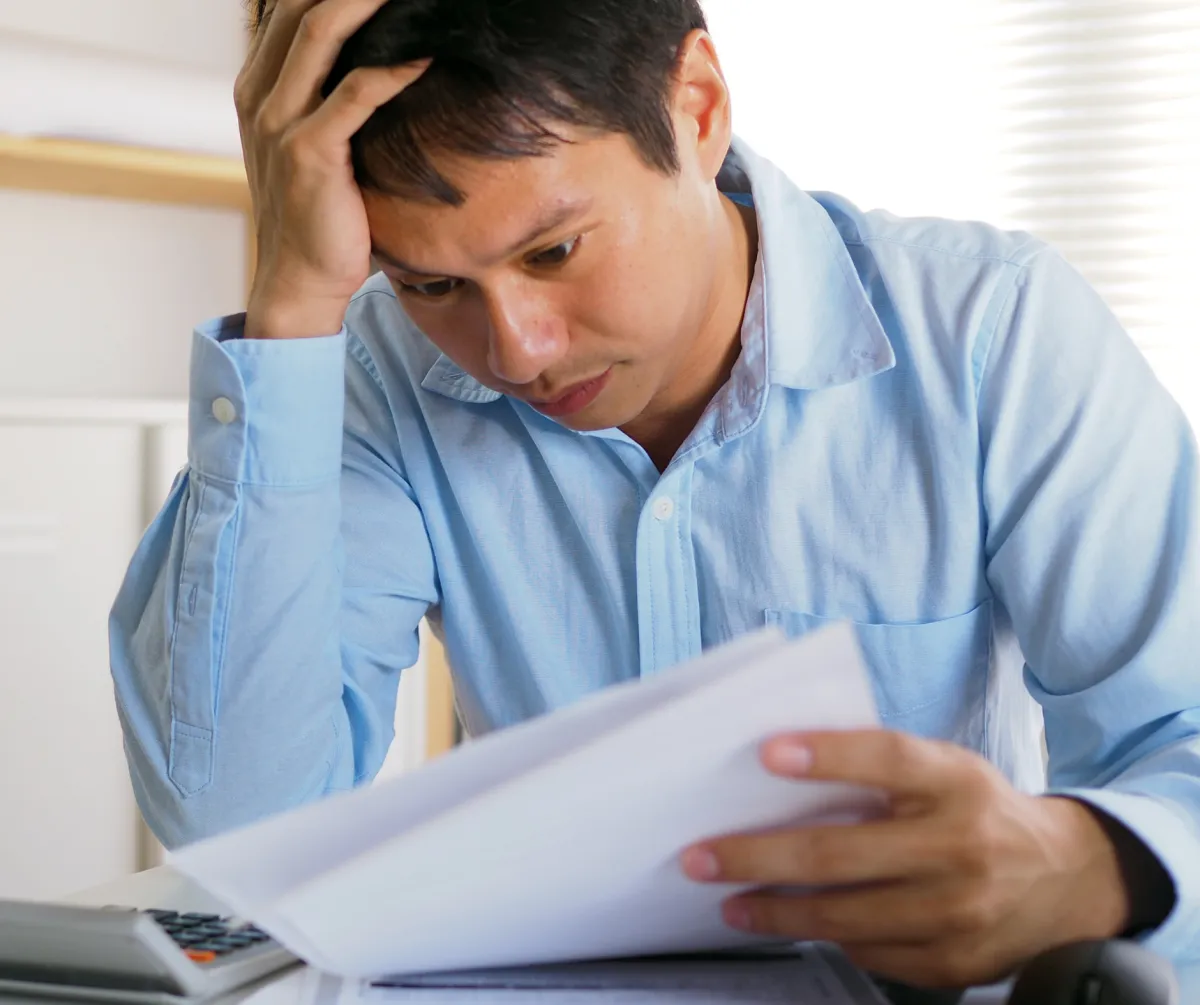

Your Wealth And Assets Have Grown Too Complex And You Know It’s Time To Organize and Protect it. But How?

Deep family divisions over unclear distributions

Millions lost to estate taxes that could have been mitigate.

Properties and business assets sold off just to pay taxes.

Spouses and children denied access to frozen accounts

What took you a lifetime to build can quickly become vulnerable to legal problems and

irreversible financial damage.

At Gbiz Wealth Solutions, we believe confidence begins with clarity. That’s why our team of financial, legal, and estate professionals work together to offer sophisticated, practical, and highly personalized solutions customized for your unique needs and stage in life.

How We Can Help

Streamline Your Life, Wealth and Purpose with Bespoke Strategies Across Areas that Matters Most

Legacy

Framework Design

Unify your trusts, wills, and estate documents into one clear, multi-generational structure that is built to protect and preserve what matters most.

Business

Succession Planning

Secure smooth leadership transitions and preserve enterprise value across generations, owners, and key stakeholders.

Smart Estate

Tax Planning

Mitigate estate tax exposure and protect your beneficiaries through intelligent structuring and liquidity-ready wealth transfer strategies.

Trust Governance

& Oversight

Establish and manage private structures to govern how assets are controlled, distributed, and protected, now and for decades ahead.

Family

Protection Planning

Safeguard your loved ones from legal and financial risk with personalized insurance and protection solutions tailored to your stage in life.

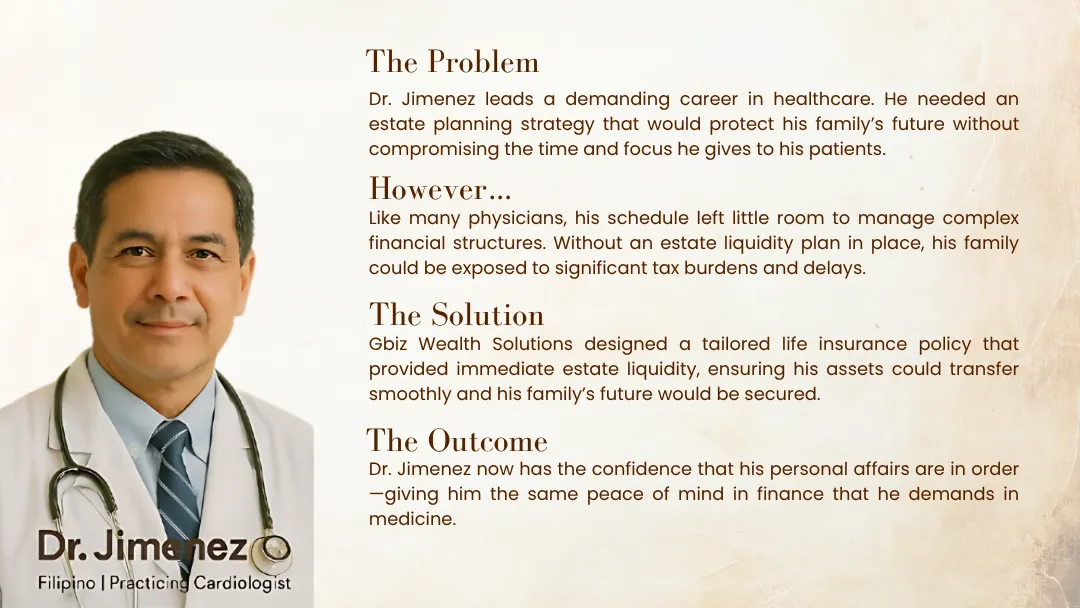

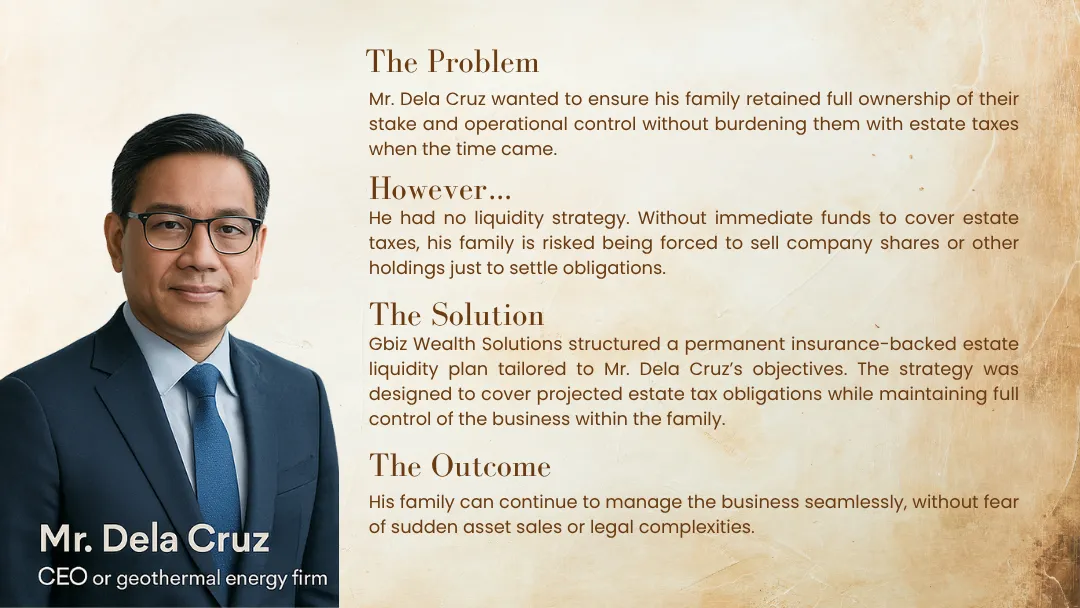

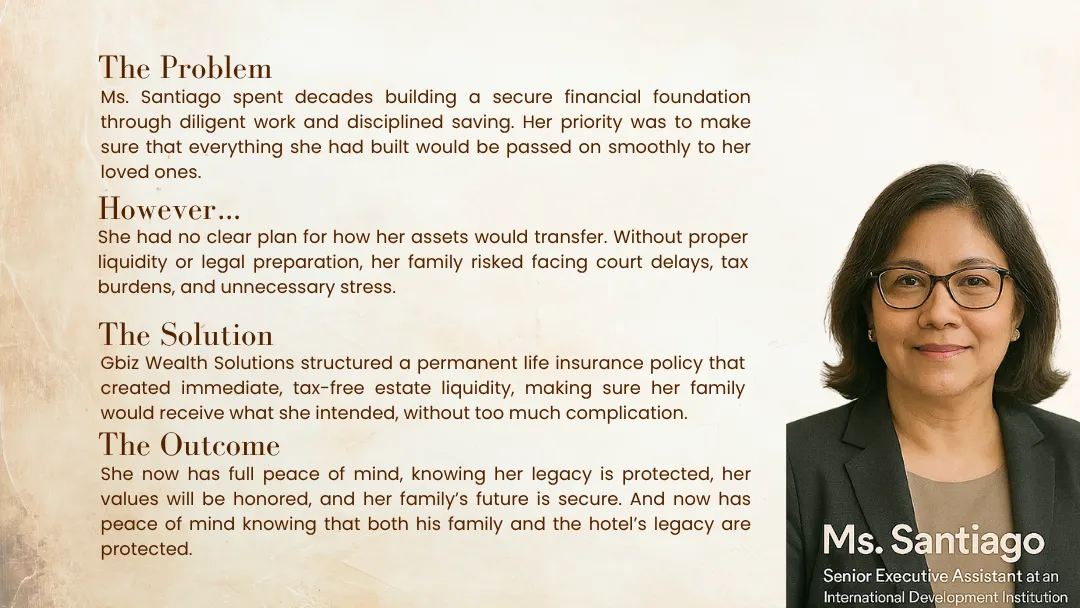

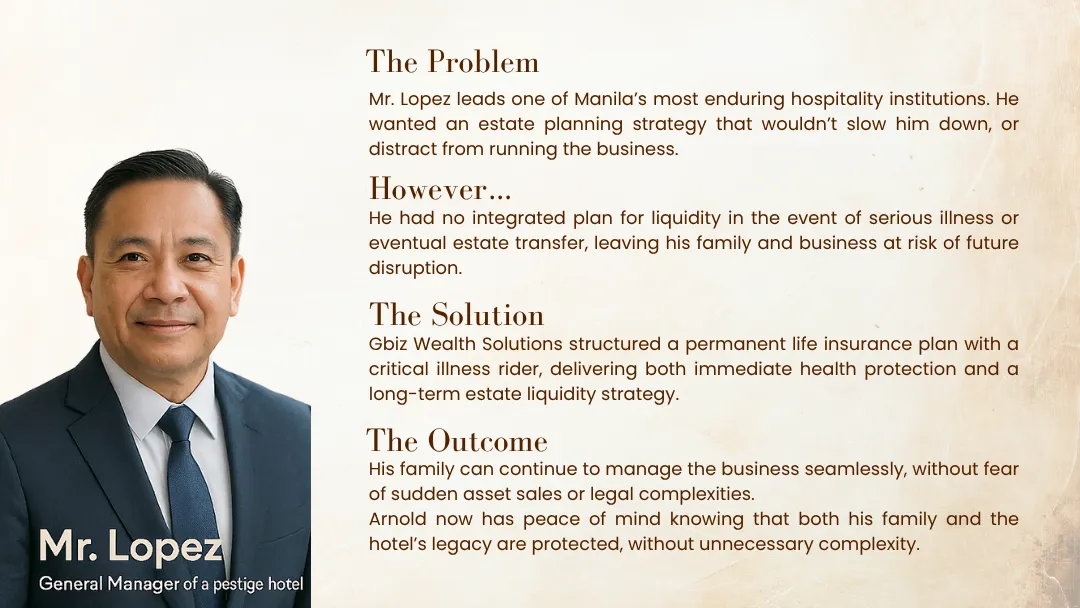

Behind Every Legacy Is a Strategy That Held It Together.

Real success stories of how multi-generational families avoided legal delays, tax loss, and family breakdown, with the right strategy in place.

And Here's What This Means To You, Your Family, & Your Business.

Protecting, managing, and transferring wealth with clarity and control is more difficult than most admit. Even with all the right intentions, many clients come to us lost in a maze of complexity, feeling like they’re no longer in control, unsure of what the future might hold.

A clearly articulated strategy is the difference between a legacy preserved and a legacy at risk.

When done right, your wealth becomes resilient, protected against disruption, tax exposure, and legal issues.

That’s why we created a guided, private advisory experience where everything you own is protected, preserved, and have a long-term family continuity.

Real Lessons from Prominent Filipino Families

The Lopez Family (ABS-CBN)

When Eugenio “Geny” Lopez Jr. passed away in 1999, his succession and estate plans were reportedly incomplete. This created control uncertainties over ABS-CBN and exposed the family’s holdings to political risk.

The Impact

Complicated control shifts over major media assets

Potential estate tax liabilities

Operational instability within ABS-CBN itself

Senator Jamby Madrigal

In 2008, Senator Madrigal publicly contested the will of her late aunt, Doña Consuelo Madrigal-Collantes, claiming forgery.

The Impact

Triggered high-profile family litigation

Reputational strain for a respected political dynasty

Delayed distribution of estate assets

Key Lessons

Madrigal’s battle triggered public-family rifts due to contested wills.

Renato Corona

Although not directly tied to estate planning, his 2012 impeachment trial revealed undisclosed assets and questionable financial planning.

Impact:

Public trust compromised

Family legacy entangled in allegations

Posthumous financial records examined under intense legal spotlight

Key Lesson

Corona’s collapse hampered his posthumous reputation due to opaque asset planning.

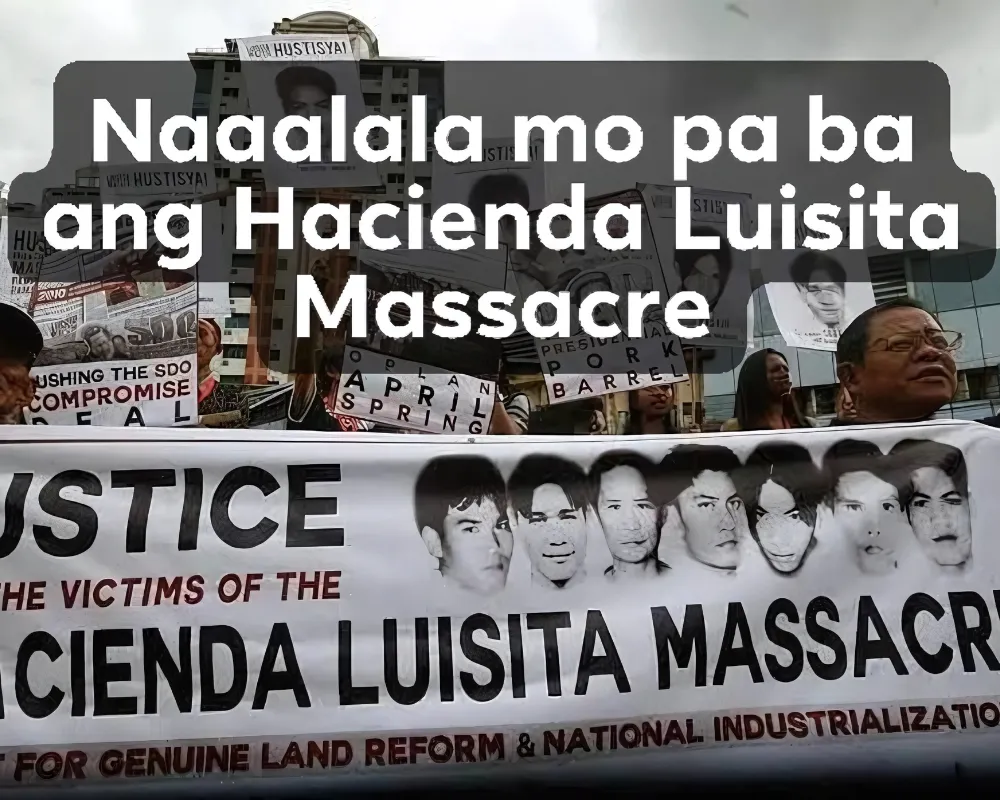

The Cojuangco Family (Hacienda Luisita)

Despite decades of land control, the Cojuangcos’ failure to implement a structured asset transition plan triggered nationwide disputes, mass protests, and drawn-out litigation.

The Impact

Family wealth locked up in protracted litigation

Distressed relationship with tenants and workers

Disruption of corporate operations and reputation

Key Lessons

Even elite families need robust estate planning. Without proper legal structuring and estate mechanisms, assets remain vulnerable.

Liquidity is essential to cover taxes and legal costs. Lack of insured liquidity can stall assets and control.

Internal disputes or unmanaged succession can snowball into extended public and family legal battles.

Public scrutiny, governmental involvement, and worker actions (like in Hacienda Luisita) can intensify inheritance issues.

Ferdinand Marcos Sr. (Former Philippine President)

Died in exile in 1989 without filing estate or income taxes from 1982–1985.

Impact:

Billions in estate taxes remain unpaid

Family estate remains frozen

Legal and public disputes spanning decades

Institutional credibility diminished and inheritance unresolved for heirs

Key Lesson:

Marcos case shows legal consequences and long-lasting stigma due to unpaid estate taxes

The Case of Lucio Tan

Why Estate & Succession

Planning Matters

Lucio C. Tan Sr. is one of the Philippines’ most prominent magnates, presiding over the LT Group, a diversified empire spanning tobacco, liquor, banking, real estate, and aviation. His son, Lucio “Bong” Tan Jr., was groomed to lead the next generation, appointed President of PAL Holdings in 2019.

Just four months into his role, Bong Tan Jr. died unexpectedly, leaving a major leadership vacuum at the helm of PAL This sudden loss struck a conglomerate with no apparent transparent succession plan, creating leadership uncertainty and governance instability.

Broader Lessons from Lucio Tan's Case

Wealth ≠ Succession Readiness

Despite near-$3 billion wealth and a massive corporate empire, the lack of clear contingency plans left the business exposed

Sudden Loss Triggers Disruption

The passing of Bong Tan Jr. showed how unplanned leadership gaps can threaten investor and stakeholder confidence.

Proactive Planning Is Key

This scenario underscores the need for well-designed estate planning, insurance-backed liquidity, and leadership continuity strategies.

The Case of Lucio Tan

Why Estate & Succession

Planning Matters

Lucio C. Tan Sr. is one of the Philippines’ most prominent magnates, presiding over the LT Group, a diversified empire spanning tobacco, liquor, banking, real estate, and aviation. His son, Lucio “Bong” Tan Jr., was groomed to lead the next generation, appointed President of PAL Holdings in 2019.

Just four months into his role, Bong Tan Jr. died unexpectedly, leaving a major leadership vacuum at the helm of PAL This sudden loss struck a conglomerate with no apparent transparent succession plan, creating leadership uncertainty and governance instability.

Broader Lessons from Lucio Tan's Case

Wealth ≠ Succession Readiness

Despite near-$3 billion wealth and a massive corporate empire, the lack of clear contingency plans left the business exposed

Sudden Loss Triggers Disruption

The passing of Bong Tan Jr. showed how unplanned leadership gaps can threaten investor and stakeholder confidence.

Proactive Planning Is Key

This scenario underscores the need for well-designed estate planning, insurance-backed liquidity, and leadership continuity strategies.

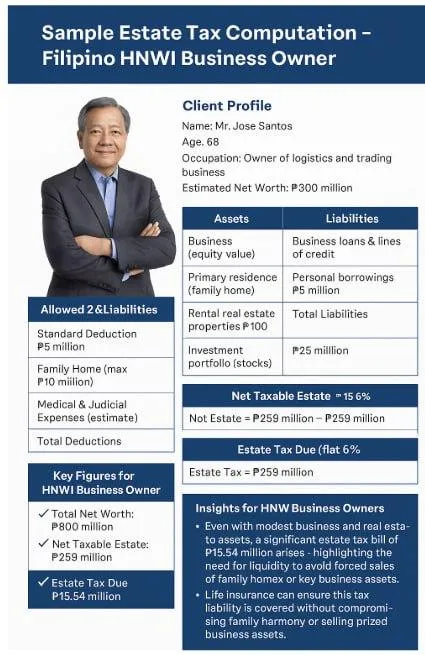

What Is The Real Cost of Poor Planning?

Even elite families are vulnerable to estate tax exposure. Without liquidity or structure, families are often forced to sell assets just to cover tax obligations.Take a look at this simplified example based on a Filipino high-net-worth individual with ₱300M in holdings.

₱15.54 million in estate tax due simply because there was no strategy in place.

How Gbiz Wealth Solutions Protects You

Estate liquidity via life insurance, eliminating forced sales

Structured succession plans, tailored for families and businesses

Legal and tax-aware frameworks, ensuring smooth transitions

Conflict prevention, maintaining both control and harmony

What Is The Real Cost of Poor Planning?

Even elite families are vulnerable to estate tax exposure. Without liquidity or structure, families are often forced to sell assets just to cover tax obligations.Take a look at this simplified example based on a Filipino high-net-worth individual with ₱300M in holdings.

₱15.54 million in estate tax due simply because there was no strategy in place.

How Gbiz Wealth Solutions Protects You

Estate liquidity via life insurance, eliminating forced sales

Structured succession plans, tailored for families and businesses

Legal and tax-aware frameworks, ensuring smooth transitions

Conflict prevention, maintaining both control and harmony

Clarity, Continuity, and Control

There’s a Better Way to Protect EVERYTHING You’ve Built & Gain…

There’s a Better Way to Protect EVERYTHING

You’ve Built & Gain…

Through an All-in-One Strategic, Multi-Generational Framework that Simplifies Wealth Complexities and Prepares Your Family for What Comes Next

Through an All-in-One Strategic, Multi-Generational Framework that Simplifies Wealth Complexities and Prepares Your Family for

What Comes Next

A private wealth & asset advisory consultation where we listen intently, see your objectives through your lens, and design a tailored strategy that aligns your assets, trusts, and obligations into one cohesive plan centered on your goals.

here’s how it works

Simplify Complexity. Protect Every Critical Area of Your Wealth.

Simplify Complexity. Protect Every Critical Area of Your Wealth.

Our team helps you completely manage your accumulated assets, align legal protections, and future-proof your wealth transfer, so your legacy isn’t left to chance.

Discovery & Clarity Meeting

We begin with an in-depth dialogue to understand your goals, family dynamics, existing structures, and risk exposure. This helps us identify outdated beneficiary designations, underperforming trusts, incomplete succession plans, or uncoordinated insurance policies, which are areas that could jeopardize the seamless protection and transfer of your wealth.

Strategy & Design Mapping

Our team consolidates every insight from our discovery meeting and begins mapping your custom legacy framework. We model various outcomes, tax impact, succession scenarios, and build a plan that protects your estate, aligns your structures, and prepares your beneficiaries for transition.

Implementation & Collaboration

With your full agreement, we initiate the implementation phase, coordinating with your existing advisors to update trusts, restructure ownership, optimize insurance placement, and prepare tax-aligned documentation. Every element is carefully handled to ensure confidentiality, legal soundness, and intergenerational clarity.

Long-Term Partnership

Your plan doesn’t end at implementation. We provide continuous support, reviewing your structures regularly, adjusting to life changes, new estate laws, or evolving family needs. Our goal is to ensure your wealth plan remains effective, protected, and aligned.

You carry the weight of significant obligations across your business, your family, and the wealth you’ve built. That’s why our proprietary framework is structured to deliver clarity, discretion, and control, without adding complexity to your life.

Here’s what comes next

Now That You Have The Family Wealth Blueprint…

A precise, high-level review of your current estate, trust, and insurance structures

Identification of silent risks, gaps, and exposures that may disrupt transfer or protection

Strategic recommendations to mitigate estate taxes, preserve liquidity, and ensure seamless succession

A coordinated plan that aligns your intentions with legal structures, asset protection, and beneficiary clarity

Expert guidance, delivered in private, with professionalism and discretion throughout

Plus, You’ll Get These Exclusive Legacy Planning Tools, For Free :

The “Life, Protected” Briefing (PDF)

A 5-page digital guide outlining what protection looks like at every life stage, including the legal advantage of irrevocable designations.

The “Life, Protected” Briefing (PDF)

A 5-page digital guide outlining what protection looks like at every life stage, including the legal advantage of irrevocable designations.

Legacy Compass Worksheet

A reflective journal to help you articulate your private wishes, ideal distribution, and values,

before any product is ever discussed.

Digital Legacy Vault (Early Access)

Private access to a secure digital vault where you can store final letters, policy notes, and transition wishes for your beneficiaries.

Digital Legacy Vault (Early Access)

Private access to a secure digital vault where you can store final letters, policy notes, and transition wishes for your beneficiaries.

Post-Session Summary Letter

A personalized, post-session summary of everything we discussed: gaps, insights, and directions.

The Team Behind Gbiz Wealth Solutions

Our team brings decades of financial and legal experience to help you secure, structure, and pass on everything you’ve built your family and to you next generations.

Ghie Barrizo

Unit Manager | Family Protection Specialist

Ghie didn’t enter the financial world because she loved numbers—she entered because she saw the quiet cost of avoided conversations.

She’s seen families lose wealth not through mismanagement, but through misalignment: policies that didn’t match trusts, unclear instructions, and documents that conflicted rather than protected.

That’s why she founded Gbiz Wealth Solutions—to offer more than just policies, but calm, intelligent planning rooted in care. Ghie has helped hundreds of families protect what they’ve built.

Her thoughtful approach and deep experience in high-value insurance and institutional sales allow her to simplify complex decisions and build wealth plans grounded in care and foresight.

Emman Paras

Agency Manager

Emman has helped leaders and families protect and grow their wealth for over 20 years. He is known for making complex plans simple, and for guiding clients with skill and dedication.

With deep experience in insurance, business, and finance, he helps high-value families create strong legacy plans that works, now and for the next generation.

Jong Merida

Wealth Manager

Jong specializes in family wealth sustainability and intergenerational planning. He guides clients through long-term planning that avoids legal issues and family conflict.

With years of experience in finance, insurance, and teaching, he’s known for making complex plans simple and effective, so your legacy stays strong for generations.

Hear It Straight From Our Clients...

Hear It Straight From Our Clients

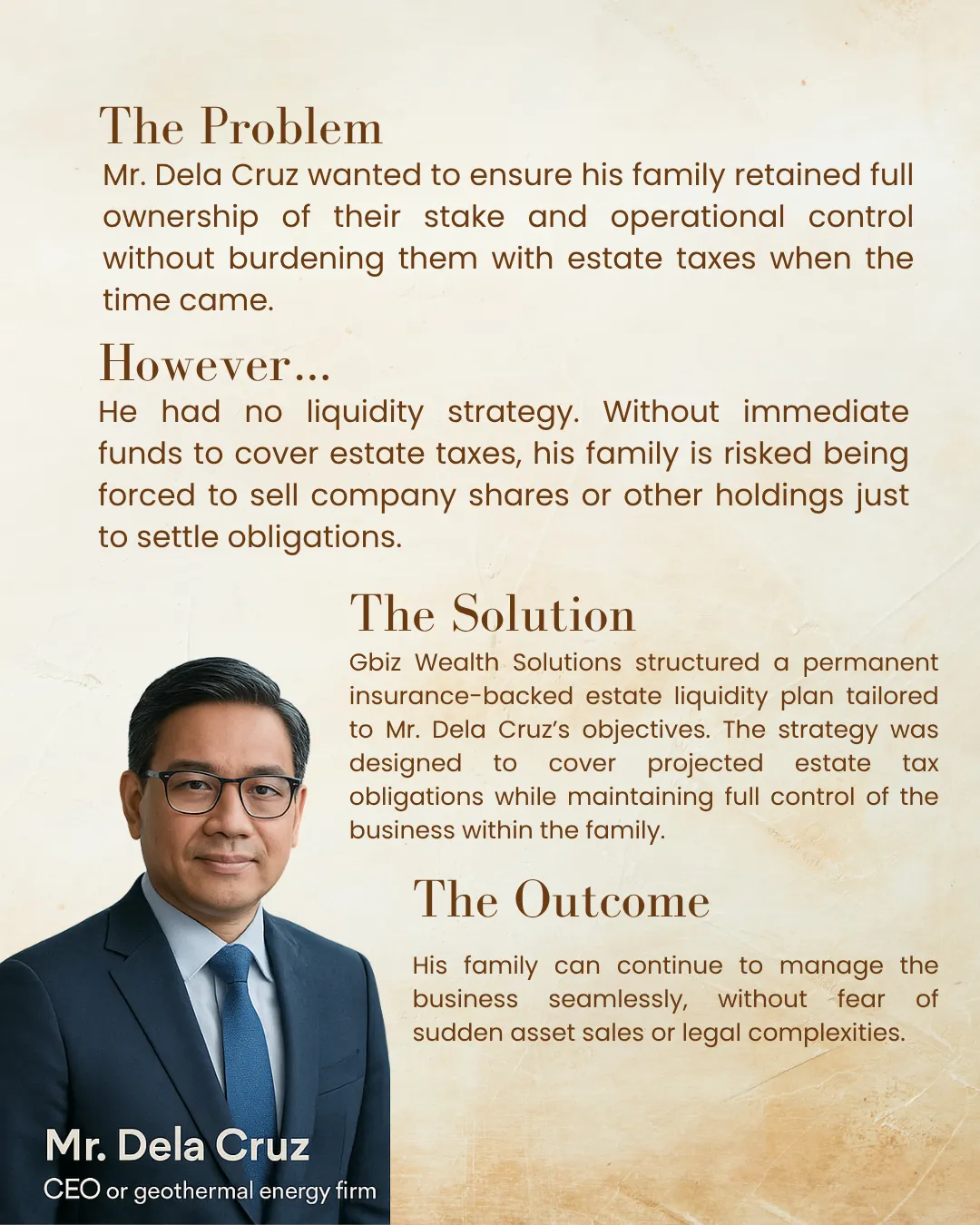

CEO

Geothermal Energy & Tech

"Gbiz Wealth Solutions gave me something I value deeply: clarity. As someone managing technical operations daily, I appreciated how straightforward and well-prepared they were. No sales talk—just solid planning, aligned with what I needed. I’d recommend them to any executive who values time, precision, and real results."

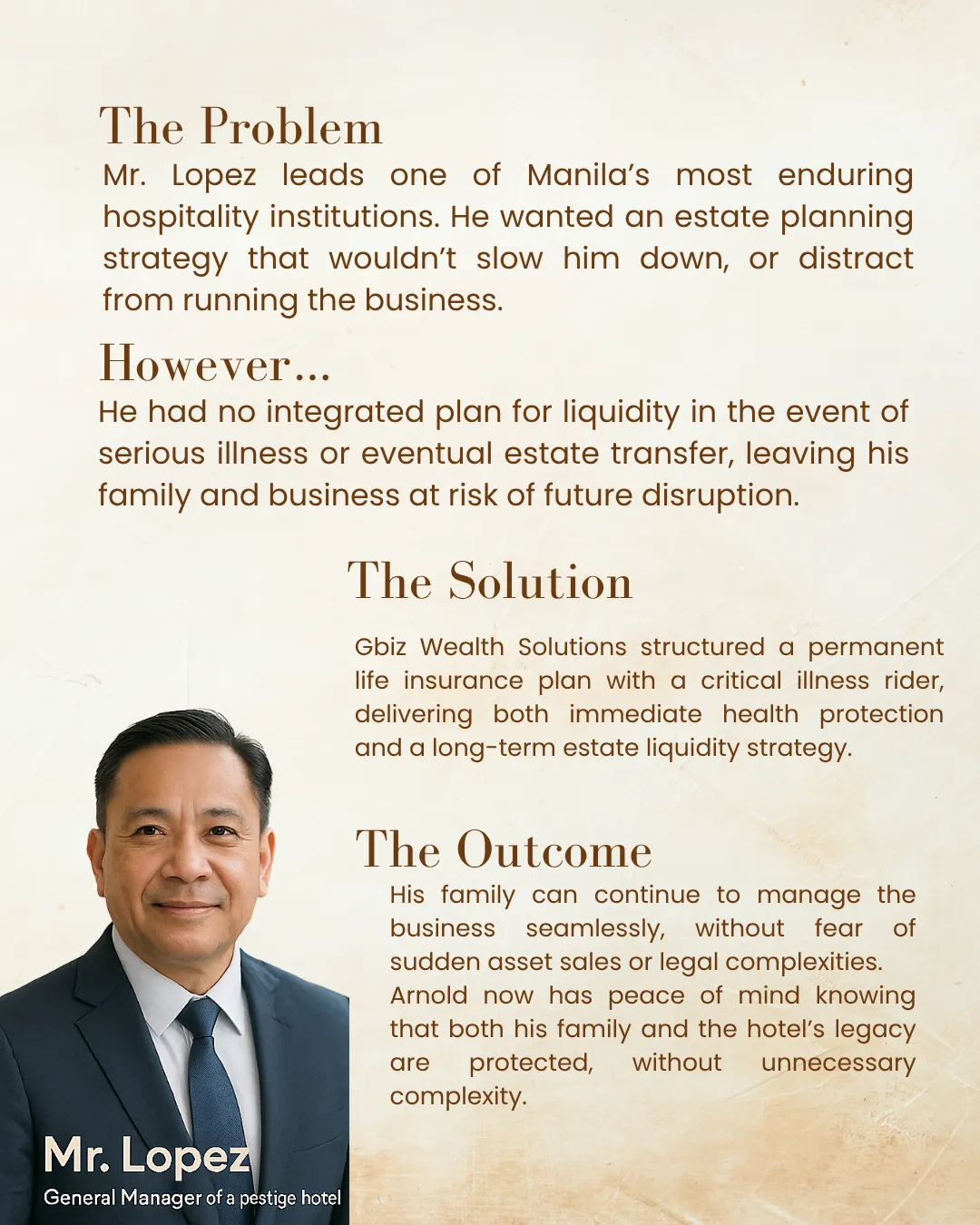

General Manager

Hospitality & Management

“Partnering with Gbiz Wealth Solutions was genuinely refreshing. In a fast-paced industry like hospitality, time is precious—and they respected that. Their approach was clear, efficient, and tailored to my needs, without the usual complexity. What really stood out was their professionalism and ability to deliver meaningful results without drowning me in jargon. They didn’t just sell products—they helped create peace of mind, which is rare and invaluable in my line of work.

Equity Analyst

Banking & Finance

"As someone who works with numbers daily, I have high standards for financial advice—and Gbiz Wealth Solutions met them. They didn’t just offer options—they offered insight. Their ability to personalize strategy without losing structure really impressed me."

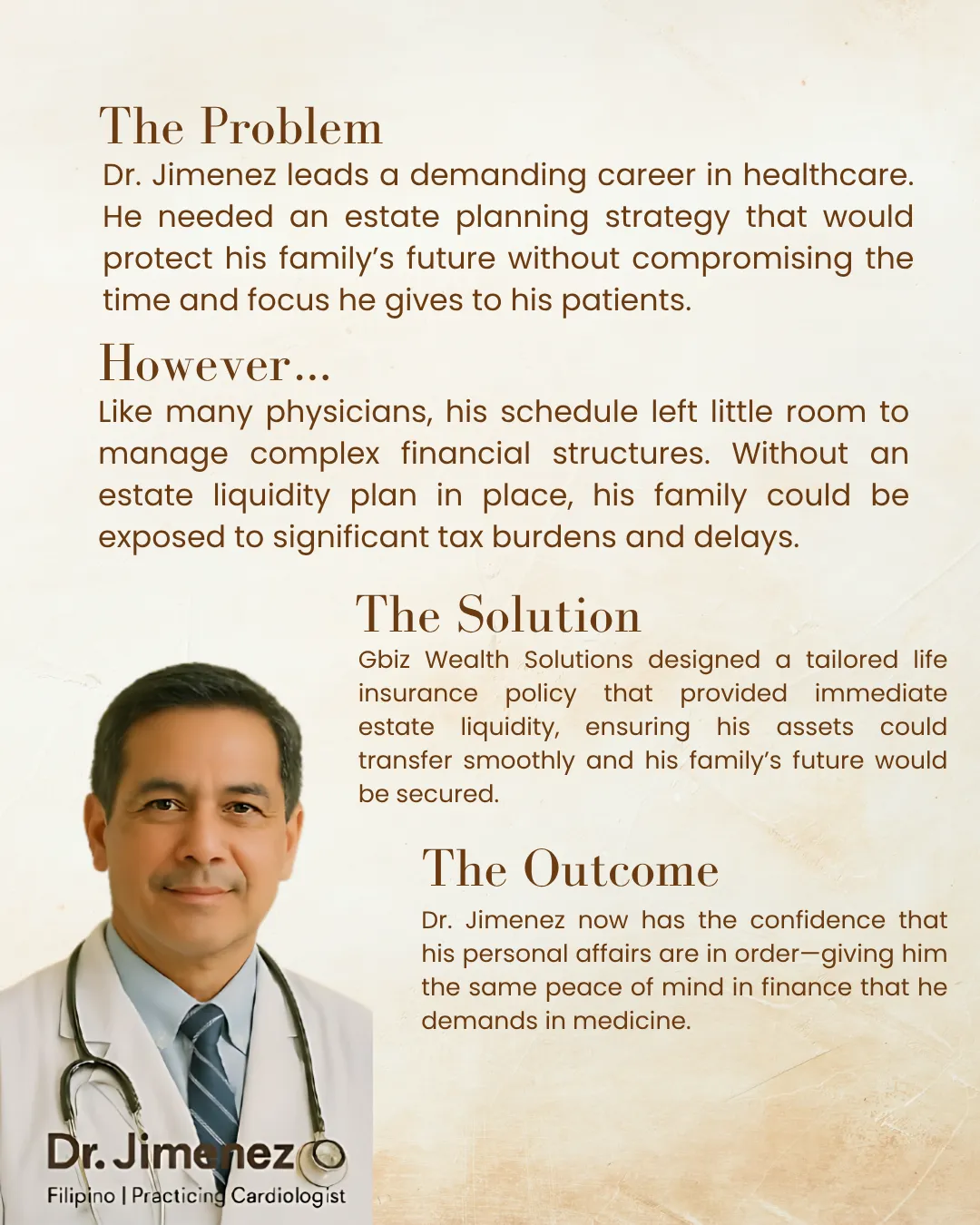

Doctor

Health

"In medicine, clarity and trust are non-negotiable—and I expect the same from my financial partners. Gbiz Wealth Solutions delivered both. Their work was thorough, professional, and adapted to my schedule. I trust their judgment the same way I expect others to trust mine."

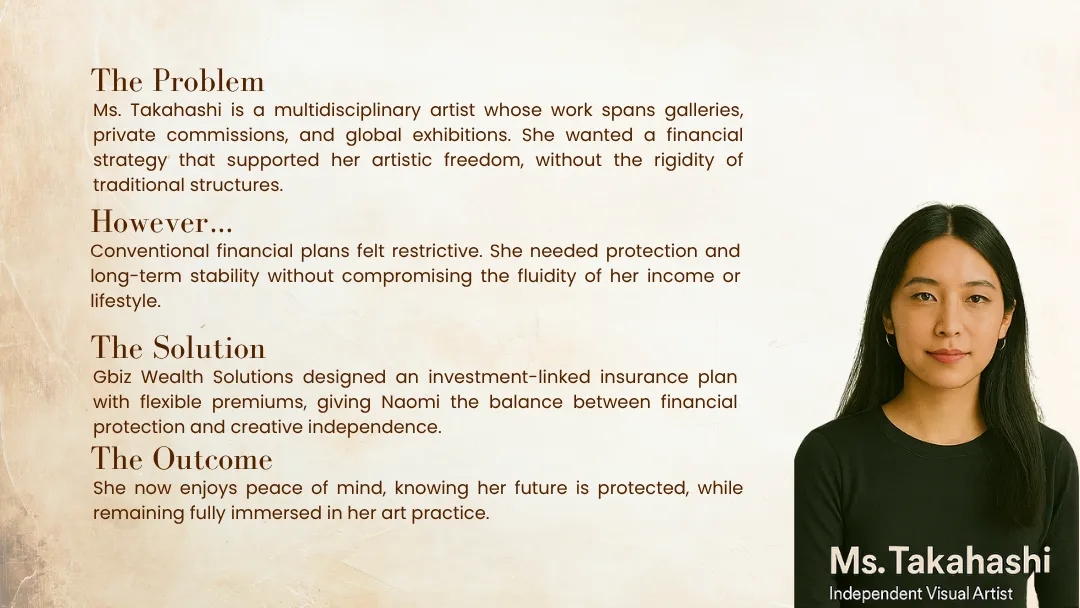

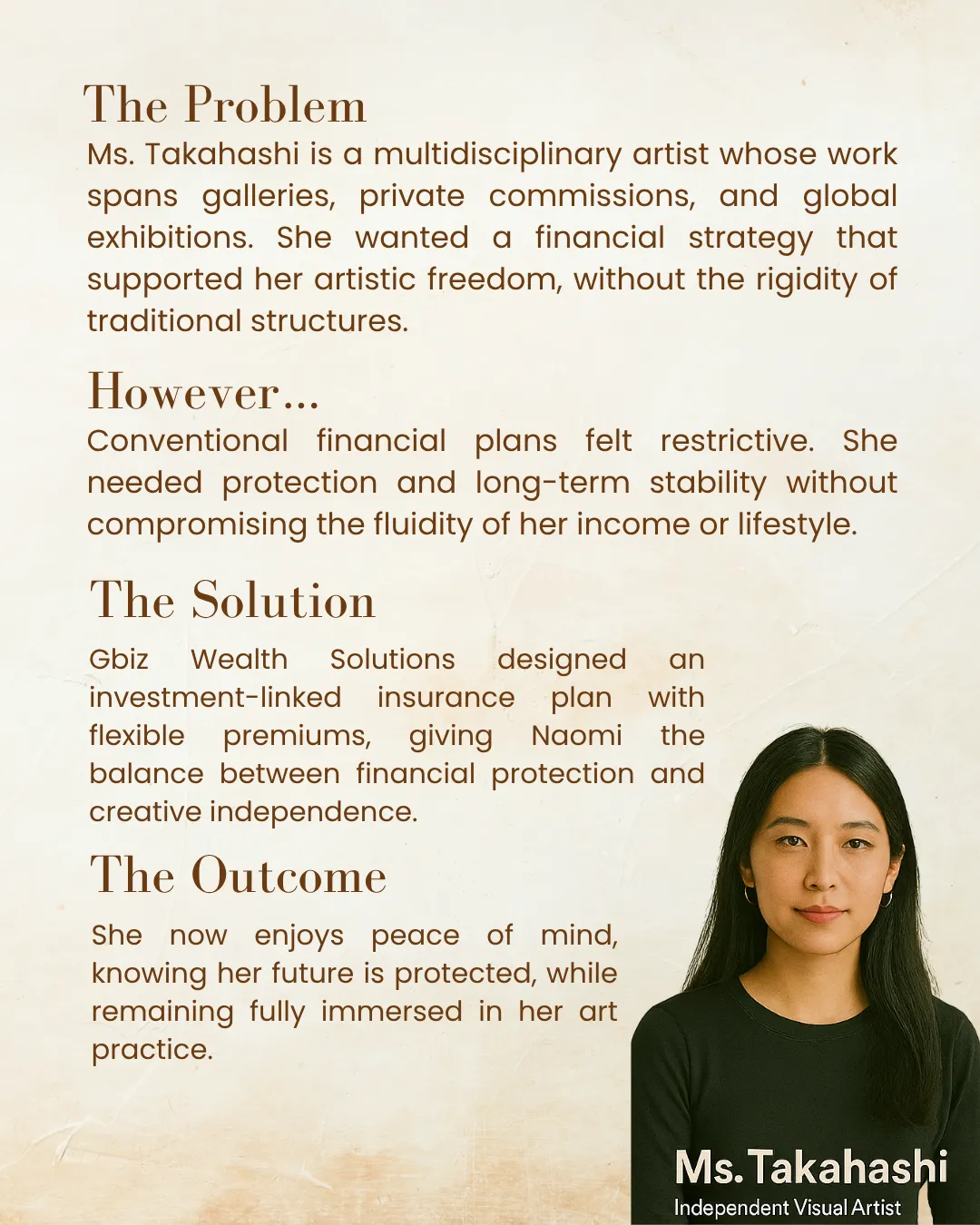

Visual Artist

Arts

"Collaborating with Gbiz Wealth Solutions was an enlightening experience. Their approach to financial planning mirrored the intentionality and sensitivity I strive for in my art. They understood the nuances of my creative journey and provided guidance that felt both personalized and profound. It's rare to find financial advisors who resonate so deeply with an artist's perspective."

President

Sports

"As a business owner, I look for clarity, speed, and real-world solutions—and Gbiz Wealth Solutions delivered all three. They understand how entrepreneurs think and what matters most: results without the runaround. I appreciated their straightforward, strategic approach."

President

Sports

"As a business owner, I look for clarity, speed, and real-world solutions—and Gbiz Wealth Solutions delivered all three. They understand how entrepreneurs think and what matters most: results without the runaround. I appreciated their straightforward, strategic approach."

Plan with Purpose. Preserve with Clarity.

Discover a discreet, highly personalized approach to managing and protecting your wealth—one that honors the complexity of your portfolio, the privacy of your affairs, and the values behind your vision.

At Gbiz Wealth Solutions, every strategy is guided by deep insight, long-view foresight, and a quiet confidence built through years of working with legacy-minded families.

STILL NOT SURE?

Frequently Asked Questions

1. What exactly is the Family Wealth Blueprint?

It’s a private advisory engagement where we assess your current estate structures, trust arrangements, insurance coverage, and succession plans. The outcome is a fully integrated, strategic roadmap that ensures your legacy is protected and passed on as intended.

2. Is this a product or a consultation?

This is not a product offering. It’s a structured, advisory consultation focused on aligning your wealth architecture. If certain solutions are needed, we’ll provide recommendations—with full transparency and only with your consent.

3. Do I need to prepare anything for the session?

If you already have policies, trust documents, or business agreements, we’ll ask you to share them beforehand. If not, we’ll help identify what’s missing and where to begin.

4. What happens after the session?

You’ll receive a personalized Clarity Letter, summarizing everything we discussed—what’s aligned, what’s exposed, and what steps will help protect your family’s future.

5. What if I already have an advisor?

That’s perfectly fine. Many of our clients come to us with existing plans. Our goal is not to replace your advisor, but to help you make sure everything is working together, not just sitting in separate files.

6. How long does the session take?

Each session typically lasts 60–90 minutes. It’s private, and paced to ensure every detail is understood, without pressure or rush.

7. Who is this for?

We work primarily with clients who manage significant wealth, family businesses, or multi-generational assets. If legacy clarity matters to you, this session is designed for you, regardless of your exact portfolio size.